Imagine yourself seated at your kitchen table, trying to make sense of a stack of invoices. Now bring in the free loan calculator. Your financial compass, this clever tool can help you negotiate the frequently choppy waters of borrowing.

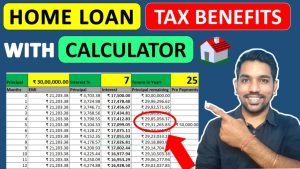

Simple is a loan calculator. Based on the loan amount, interest rate, and length, it lets you estimate your monthly payments. You punch the numbers and voilà! You are quite clear about what to expect. Less conjecture now. Anxiety over unanticipated costs is overblown.

Let’s explore further. Consider yourself staring at that new automobile. You want to know whether you could swing the payments without running afoul of budget. You enter the loan term, the price, and the interest rate your lender charges. The calculator puts forth a number almost immediately. This figure might be revolutionary, possibly saving you from later on financial heartburn.

But halt there is not enough. Many calculators come with extra capabilities. Some people can project your lifetime loan interest payment amount. Others let you experiment with several situations. Suppose you could pay a little more every month? Could you perhaps cut the term? These tweaks can result in really large savings.

Let us now specifically address interest rates. They can seem as a moving target. They are down one day; then, who knows? A loan calculator will enable you to see how your payments might vary even with a small interest rate adjustment. Think twice if you believe a quarter percent point is not important! That can mount up over time to be rather large.

You have two loans, for instance. At 3% one and at 5% another. The difference initially seems to be not very great. But over the course of a thirty-year mortgage, that additional 2% might cost tens of thousands of dollars. Depending on your perspective, a loan calculator will enable you to perceive the shadow—or brightness.

Not overlooked are finances. A loan calculator can enable you better financial planning. Knowing how much you can afford to borrow can help you to create reasonable budgets without overstretching your means. This will help you avoid a pickle down road.

Flashy ads and tempting offers can easily sweep you away while seeking a loan. A loan calculator filters the noise. It helps you to be clear enough to make wise selections. Armed with knowledge, you can approach lenders prepared to negotiate like a professional.

Consider it as your reliable friend in the financial field. There, just waiting to assist you at any moment. Must figure out a student loan? Investigate. Want to find out your house affordability range? Ask. You can figure out how much you need to save even if your daydreaming about that trip is merely hypothetical.

And let’s face it: everyone loves a decent financial return. Knowing your figures can be empowering whether your goals are debt consolidation or gadget purchasing. You will sense your own control. Knowing your financial condition gives one great confidence.

Now, if you use a loan calculator, be sure you double-check your inputs. Like a missing decimal, a little error might have rather different results. Like making a cake, you will have a disaster if you overlook the sugar. That also applies to your finances.

There are plenty of online calculators, some more user-friendly than others. Search for one that lets you readily control variables. Moreover, a decent calculator would include clear calculations explanations. Should it seem very complex, you could be better off looking for another instrument.

Finally, a loan calculator is a lifeline not only a fancy tool. It guides your financial terrain. Its help will help you to prevent needless worry, budget sensibly, and create reasonable expectations. Therefore, keep in mind that this small instrument can change everything the next time you are considering a loan. Accept it and let it lead you to financial tranquilly.